How To Enjoy

Tax-Free Shopping

in France

With international travel having now resumed to near normal levels, tax-free shopping is once again a hot and relevant topic for travellers!

Historically, travellers would come to the UK, specifically to reap the benefits of designer stores, followed by a much appreciated tax-rebate upon leaving the UK. However, that all came to an end on 1 January 2021. Now that life has returned to a new normality, international travellers alike are asking about a new way to tax-free shop abroad. And now UK residents can join in too!

Hashtag Life have discovered the perfect solution for tax-free shopping, with a simple trip to France and the help of WEVAT.

Why France?

France has long been a favourite holiday destination, Paris for its fashion, South of France for the weather. Following Brexit, UK residents can finally also enjoy VAT-free shopping whenever they visit France, thanks to Wevat.

Did you know that Brits have a habit of failing to reclaim their entitlement to VAT? Statistics at the end of 2021 showed that there was £23billion of reclaimable VAT, 67% had never claimed tax following a trip abroad, and 75% of Brits were unaware they could even reclaim their share of the tax.

This is where Wevat can help!

About Wevat

Wevat was founded in London in 2016 as the first digital VAT refund provider for international travellers. At present, Wevat assists traveller whenever they visit France to reclaim their VAT on shopping, and eventually will serve travellers across multiple European destinations.

In fact, it is both astonishing and reassuring to hear that to date Wevat have helped refund travellers from over 88 countries for more than €18 million worth of shopping. Through our own research, we have found that Wevat makes the tax-free shopping experience convenient, efficient and trustworthy for all travellers with its revolutionary digital solution and customer-focused service.

Their services are available no matter your country of residency. For example, Wevat has partnered with Asian digital payment providers such as Alipay and WeChat Pay to better serve their Asian clients.

How Does Wevat Help?

In France, VAT is charged at an outstanding 20%.

As non-EU residents, you are entitled to that VAT being refunded back to you when you leave Europe. However, individuals cannot claim VAT refund directly. You must go through a registered company. How much of that VAT you are refunded has normally depended upon what the entity, making the refund on your behalf, keeps for itself.

Wevat offer the best tax refund rate

Wevat offers a much better refund rate compared to any other provider that we have come across. Also, Wevat deals directly with you, the customer, and not with the retailer. This means that when purchasing your goods, you will take home a VAT refund of 13.3%, which is much better than the traditional 8-12% found with other traditional providers. The return to you is higher because the retailer doesn’t take a cut.

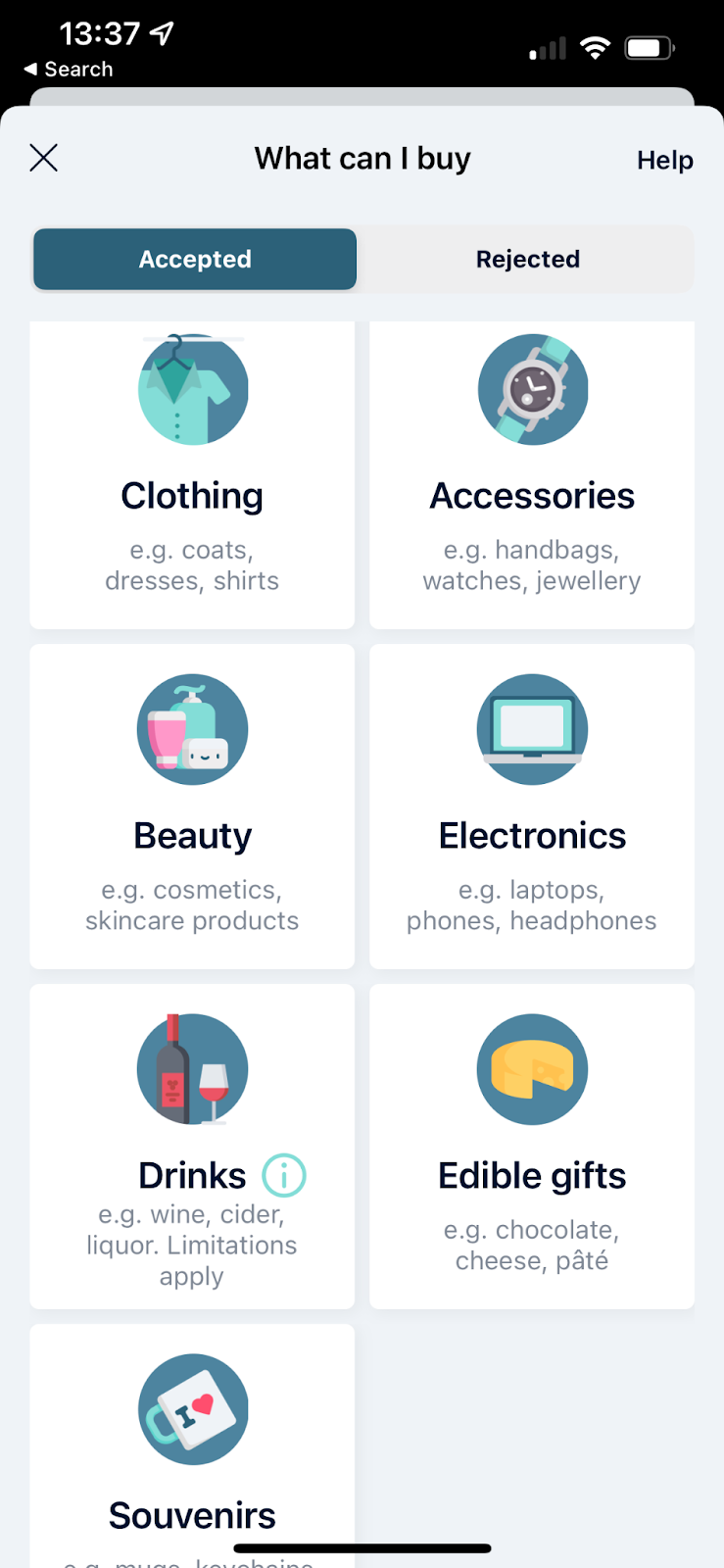

Another perk is that Wevat does not require you to have a minimum spending amount per retailer of over 100 Euros. Infact, Wevat will process your VAT refund as long as you spend over 100 Euros during the entire trip. So whether youre off to purchase that dream Chanel or Hermes handbag, or looking for some special French wines, you will come back home with some extra money in your bank account.

With these main advantages covered, let’s get into how the Wevat process works.

How does Wevat work?

Start by downloading the Wevat app and registering an account. From then, you are ready to begin your shopping in France.

When visiting a retailer, and before purchasing your items, we advise you check with your Sales Associate that they will be able to issue a purchase invoice made out to Wevat.

In French, you will need to ask for a “facture”. Most retailers are familiar with the request for a facture and will accommodate your request to make out the invoice to Wevat, but whilst the app is growing in popularity you may still need to ‘educate’ any unfamiliar Sales Associates.

Stores have a legal obligation to issue invoices upon request, so you don’t need to provide any justification when you request the invoice. In fact, for those interested, there is a statement to that effect on the French authority’s official website.

Once you are ready to purchase your items from that retailer, be sure that the facture is addressed to Wevat. This is essential for the whole process to work. Detailed instructions on how to do this can all be found in the app, with even an on-screen example to show your Sales Associate.

Next, take a photo of the invoice with the in-app camera, then upload with a single tap. You must do this straight away and whilst you are still in France.

Verify your identity by scanning passport and taking a selfie. You can then generate a digital refund form after spending more than €100 in total.

On the day of your departure from France – You will need to take your goods to a Wevat supported departure point at the airport or station, which can be found listed here. Once you are at your departure point for leaving France, visit a PABLO kiosk and scan the refund barcode. To receive your refund select your preferred currency and method to receive your refund within 7 days.

And that is all you have to do! You will then receive your refund within a week of departure in your selected currency and refund method.

We’ve already booked our trip to Paris and will be bringing you live coverage of our shopping experience with Wevat! Can’t wait to visit all my favourite boutiques in Paris!

Follow @hashtaglife on Instagram to keep uptodate on all our travel and destination reviews.